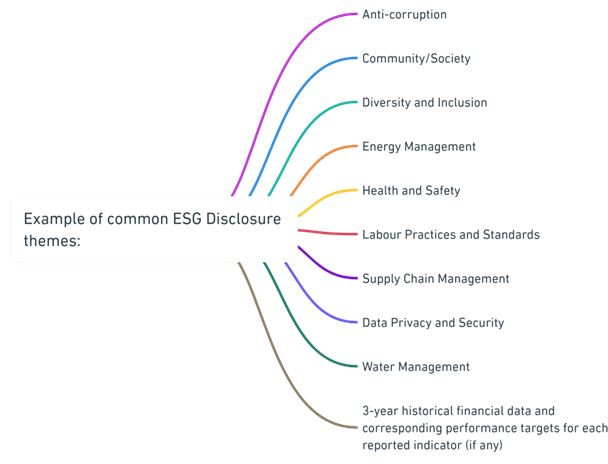

Our process initiates by zeroing in on essential ‘Parent’ disclosure areas, which have been set out by

the global and national frameworks that have been pre-built into the ESG Disclose platform.

• Anti-corruption

• Community/Society

• Diversity and Inclusion

• Energy Management

• Health and Safety

• Labour Practices and Standards

• Supply Chain Management

• Data Privacy and Security

• Water Management

• 3-year historical financial data and corresponding performance targets for each reported indicator (if any)

Our internal team of ESG Subject Matter Experts (SMEs) leverage their extensive knowledge and experience with major ESG frameworks, including those utilised by Global ESG Frameworks, to meticulously dissect the Parent disclosure indicators into more refined and detailed ‘child’ disclosure questions. This meticulous approach ensures that each essential data component is accurately pinpointed and gathered, facilitating thorough compliance with the established requirements.

Our specialised team of SMEs provides in-depth assistance to clients with data collection, ensuring the process

is as straightforward and efficient as possible. To simplify this task, we offer the option of presenting the

Disclosure questions via a Google Sheet. This method eliminates the need for a complicated software onboarding process, optimising convenience, and efficiency in data acquisition. Subsequently, our SMEs will manage the transfer of the collected data from the Google Sheet to our sophisticated software, thereby facilitating a comprehensive and seamless analysis process.

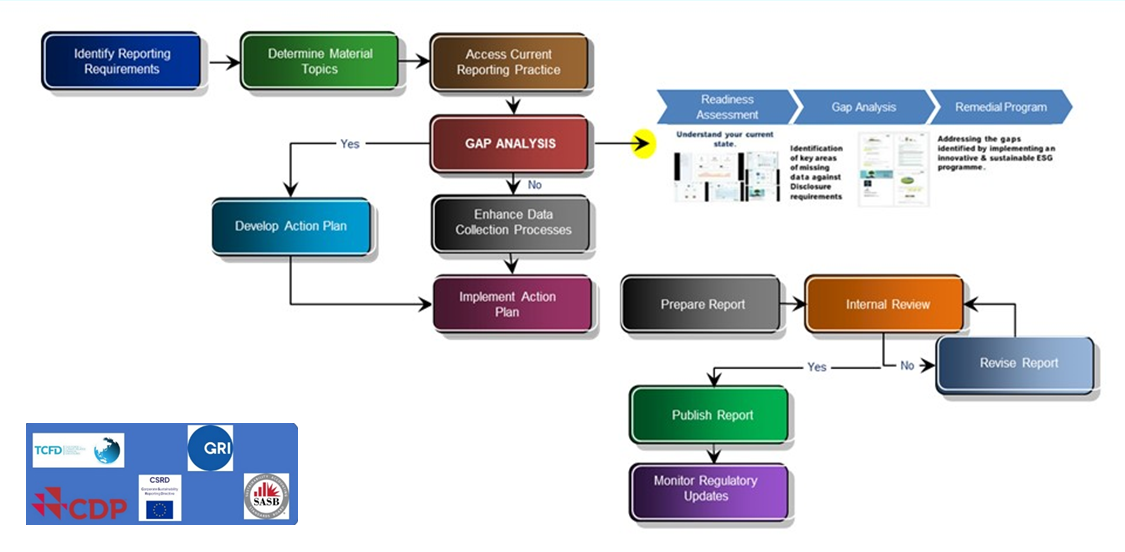

Post data collection, a detailed analysis will be conducted by our SMEs, culminating in a Readiness

Assessment & Gap Analysis Report. This comprehensive report will spotlight areas where data may be

lacking or insufficient, delineating the potential impacts of such gaps on your disclosure compliance.

The aim of conducting the ESG Readiness Assessment is to clearly identify areas that a client needs to

focus on and use the gap analysis produced by the assessment to develop a robust, informed

remediation plan of action to improve ESG adoption, practices, and compliance. Our team will facilitate an engaging presentation, delivering insightful feedback based on our findings. This session will last approximately two hours, providing opportunities for a robust discussion, ensuring that your team grasps the nuances of the readiness assessment, the implications of the findings, and is well-prepared with strategic next steps for consideration.

We are committed to providing a seamlessly integrated and strategic approach to help you navigate

through the complexities of ESG disclosure compliance with utmost confidence and precision.